How To Save To Travel The World? The Money-Saving Technique No One Is Talking About In The Travel Niche

Are you looking for a unique and effortless way to save to travel?

Want to learn how I easily saved an extra $1,000 for travel using the Acorns app?

I got you!

I am about to spill all the details on how I was able to save up a little over $1,000 using Acorns (with screencaps of my savings), how it can help you save this amount (and more) in the background, and with spare change.

Literally.

The trick to easily saving $1,000 for travel doesn’t have to do with pinching pennies, sacrificing everything you want for the bare necessities, or even paying that much attention to trying to save $1,000 for travel in the first place, and I’ll explain why in this post.

Even if you’re “bad” at saving money (a story that you can change, by the way!), or feel a certain resistance to saving it because you want to spend it on other immediate things, none of that has to do with what I’m about to share with you today, and how I saved an extra $1,000 for travel.

Before we get into the nitty-gritty, I do want to point out a few things as a premise before any action is taken.

Before you even start to move any money around, it’s important to work on your mindset regarding money and saving it.

How exactly?

- By bringing clarity to what your goal is, which in this case, is to travel with an extra $1,000 in your pocket!

- Creating your intention: to have an extra $1,000 for travel experiences and expenses.

- Deciding what you want to use this money for: be specific here, just saying “travel” isn’t going to cut it.

- Where do you actually want to go? Think of that city? Or country!

- What do you want to do?

- What do you want to experience?

- The more specific you are, the clearer your vision for your travels, and what you *actually* want to do/experience, and the more motivating, exciting, and realistic your end goal of traveling with an extra $1,000 becomes. We don’t want anything fuzzy here.

The more you spend time on this before moving a single penny into a savings account, the better your mind will be primed to find various ways in your current situation, in which you can effortlessly save extra cash, in addition to the tool that helped me save $1,000 that I’m going to talk more about.

Plus, getting your mind on the same page to what you will be doing physically, will make the saving money process smoother, and we want that!

While I first started working on my money mindset intentionally about a year and a half ago, I got to clarify all those questions personally (creating the intention and deciding I’d be traveling with an extra $1,000).

Almost immediately, my brain started to become aware of different ways in which I could effortlessly set money aside for a travel fund, and that was when I first heard about Acorns.

Acorns is a savings and investment app that offers a variety of finance and savings/investment options depending on your goals, but is so user-friendly for those of us new to the world of investment, and who want to save a bit of money off on the side.

And honestly, it’s an amazing way to get started on how to save money for travel as a student.

Let’s read on with how exactly.

Like it? Pin it!

>> Related Post: 5 Motivating Ways to Start Saving Money for Travel

How To Save To Travel? The Money-Saving Technique No One Is Talking About In The Travel Niche

How to save to travel with the Acorns App:

Acorns offers 3 tiers that help you pick out which savings option meets your financial objective, which include: Acorns Lite, Acorns Personal, and Acorns Family.

Acorns is more than saving money, as it includes a wide variety of financial options, potential, and possibilities to create wealth through investing in a variety of portfolios such as retirement, college, and more, as well as gaining access to professional financial advisors, other investment opportunities, and multiple ways of growing your wealth.

In today’s post, however, I want to keep it simple and talk about how I was able to effortlessly save an extra $1,000 with my spare change, literally, while focusing on one portfolio for now.

Once you choose your tier (lite, personal, family), you decide how much (if you so choose to) to invest monthly, you can choose your desired amount depending on what your goals are, as Acorns allows you to invest as little as $1 a month!

You then go ahead and add your banking information and link your credit card/debit card that you use for purchases.

This is important, as the card you link to your Acorns account will be the one that will record your spending and round up your purchases.

The funds will be transferred from your bank account to your investment/savings account with Acorns until you decide to withdraw. The minimum to withdraw is $5.

For instance, if I spent $15.50 on a meal out, and I paid with my card that’s linked to my Acorns account, Acorns would round up to the nearest dollar, so $0.50 would be taken out of my bank account, and transferred to my Acorns account, and that will happen each time I purchase something with my card.

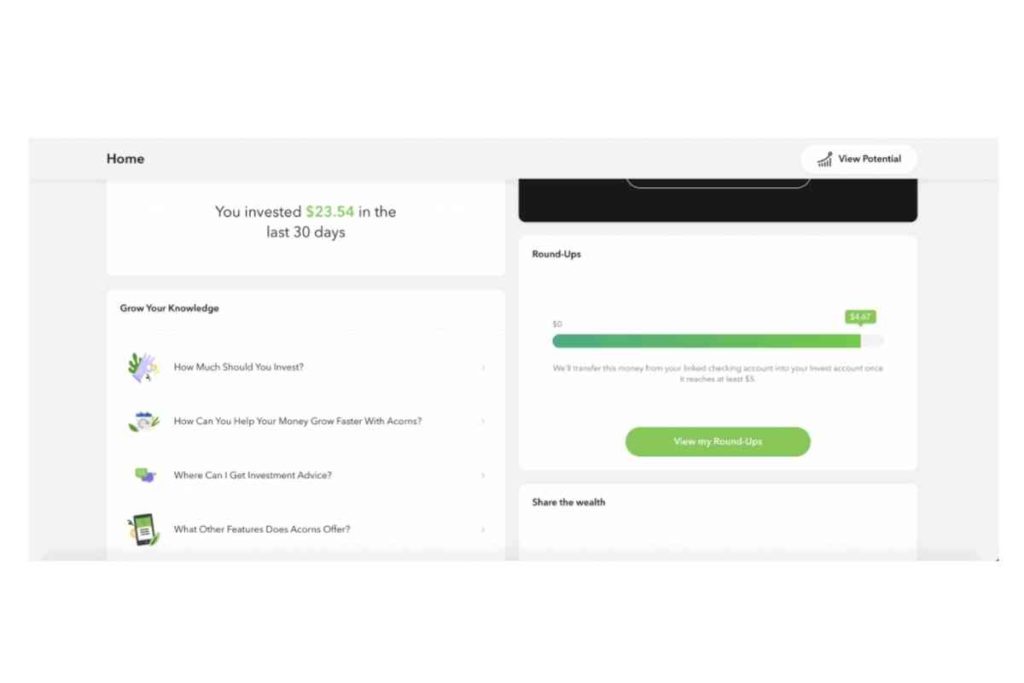

Until my round-ups reach $5.00, that is when they will be added to my travel fund portfolio.

That’s what I mean when I say that my spare change has literally helped in saving $1,000 of extra travel money!

>> Read More: How To Start Traveling After College – Here Are 7 Exciting Options For You!

Some of my favorite Acorns features

So, what’s one of my favorite things about Acorns you may ask?

Their round-up feature essentially rounds up each purchase to the nearest dollar, made from a linked bank account.

It’s all adjustable, so you can increase or decrease that amount, as well as decide if you want to invest a monthly amount from your checking account to your Acorns account or make a one-time investment to really give your account a boost, which I have done in the past.

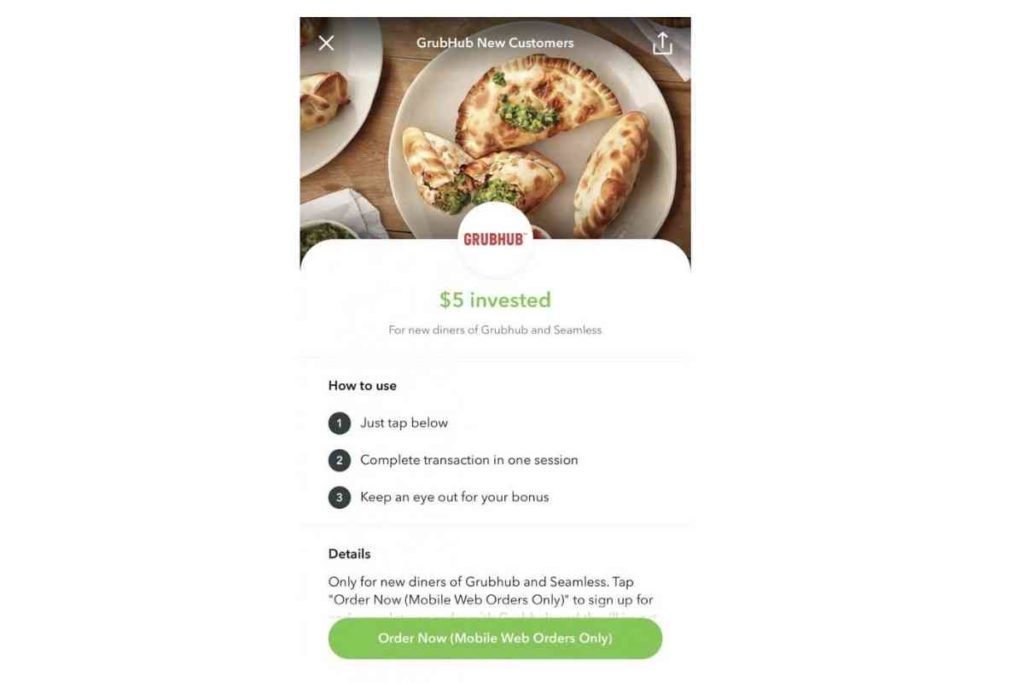

Another cool feature is that when you shop with over +350 top brands including Nike, Airbnb, Apple, GrubHub, and more, those brands will invest a certain percentage back into your account! Just make sure to read the details of how to get the investment bonus, and you’re well on your way to saving to travel the world.

How EXACTLY can you rack up an extra $1,000? An example

I stumbled into the Acorns app in January 2019 and since then, I have successfully and easily saved a little over $1,000!

I didn’t really have many expectations, or awareness of how long it would take based only on my spending habits, spare change round-ups, and monthly investments to accumulate a substantial amount, but I decided to go for it anyways.

I chose to start out with the Acorns Personal (which is $3 a month) and invested $10 for starters each month.

I thought, why not, let’s try it out and see how much I can save on here, again not really having expectations around saving much or knowing how easy and hands-off it could be! I started this back in January of 2019.

When I checked in November 2020, I had accumulated a little over $1,000, which again, for it being mostly spare change (round-ups) from my purchases, a few investments I made earlier in the year that accumulated to $400, and then my monthly $10 investments, I got to the grand total of $1,115!

What I really like about Acorns is the ease and the user-friendly capabilities of this app.

The online portal allows you to see exactly how your money is growing in your account(s), how exactly the round-ups are working with your purchases, how many round-ups you’ve had, the amount of each, and more!

Why it’s the easiest way to save at least $1,000 for travel!

I started using Acorns back in January of 2019, and now I feel I have enough user experience to give a more concise experience review of sorts.

The app really makes it easy to save money by rounding up the purchases you’re already making with the cards you’ve linked to your account, as well as adding a small monthly investment to start out with.

It’s literally been something I’ve had in the background, to the point that I sometimes *forget* I have.

It’s really a nice surprise to log in each time once in a while, and see how much money has been invested based on the roundups and the monthly investment! It gives me peace of mind knowing that I am growing my money and saving it, and in this case, I can use the ending amount for travel, unexpected expenses, or whatever I’d like!

Something I really like about Acorns is the “potential” feature, which shows you the details of the rate at which you continue to invest a certain amount of money, plus the round-ups, you can see how much your money can keep growing over the years, which let me just say, is very motivating to see!

Also, as I mentioned, you can choose to invest a monthly amount into your account, or not. So you can solely have your spare change create your wealth over time if you really wanted to!

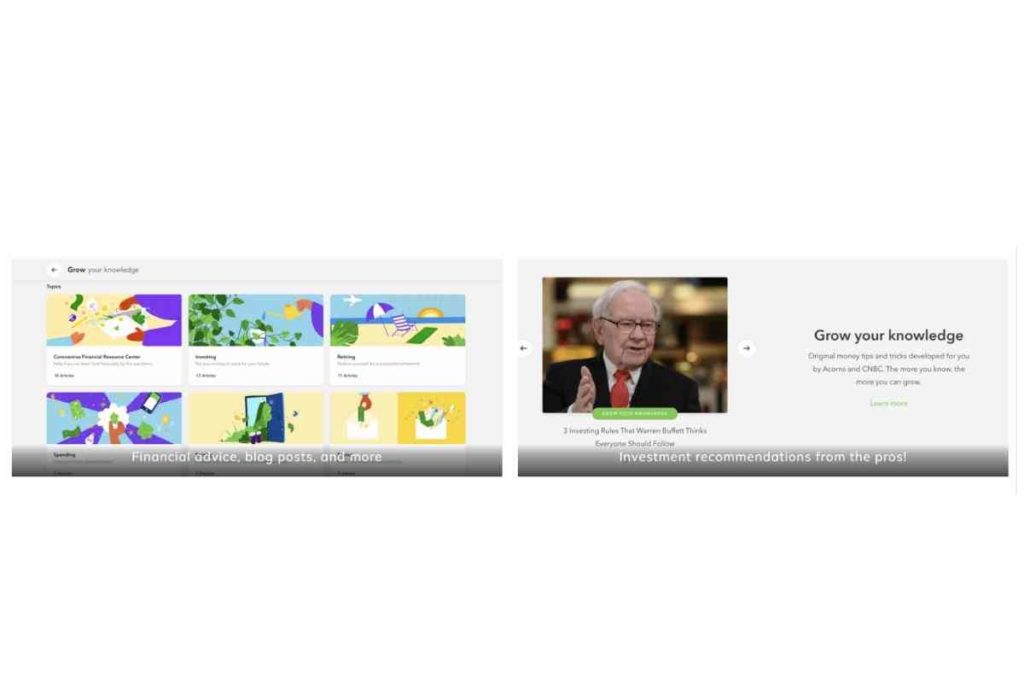

Acorns users also love the possibility of learning more about investment, the how-to’s and accessibility to creating wealth, asking professionals through the app and a clear description of where the money is going, and of course, full control of it as well. Also not to mention, it is completely safe, as it is backed up by world-leading investors and bankers, as well as used by over 8 million people worldwide!

Withdrawing the cash is also super easy, accessible whenever you’d like, and usually appears in your bank account within a few days! No commissions charged!

So, If you’re already making daily purchases for food and other items in your daily life, why not make it work for you?

How much should you save to travel?

As you can see so far, and as you’ve probably seen on your internet search, there are plenty of ways to save money for travel – I however really wanted to highlight this one with the Acorns app that I don’t think a lot of people know about.

When it comes to *how much* you should save for travel, it really comes down to personal taste, intentions for your trip, duration of your trip, and season when you’ll be traveling.

However, how would it feel to have an extra $1,000 or even $200 bucks that you were saving on the side *as* you were already making your everyday? Whether it’s an extra $100, $300, or $1,000 – it’s still unexpected money that the app saves for you, and you can withdraw easily to use on lodging, activities, or a nice meal.

There’s no limit on how much money you can save using this app, which is incredible and super handy if you want to save to travel the world with the app.

Try Acorns for as little as $3 per month to get your travel funds started today!

Concluding thoughts about How To Save To Travel? The Money-Saving Technique No One Is Talking About In The Travel Niche

When you work on your mindset surrounding travel and money, depending on your current relationship with money, you may feel a bit of resistance coming around the HOW of saving money to travel.

Thoughts such as “I don’t have money” or “where is this extra $1,000 going to come from?” may come around, which is why it’s important to establish firstly your why more than your how when you’re trying to save money for travel.

When I was getting clear on my travel and financial intentions, my brain started to become more aware of more ways to help sort this out for me.

I researched different methods and tools that could help me start and save an extra travel fund.

I was looking for something easy, something automatic, and something that wouldn’t feel like a tedious job. Enter Acorns, the app that literally turned my change into travel funds!

>> Read More: The First Step To Do When Planning A Trip Not Many Do

If you’re interested in checking out if Acorns is the best money-saving, travel fund starting app for you, or even a start to understanding how investment and portfolios work for other areas of your life, I can’t recommend Acorns enough!

Click HERE to check it out!

If you do decide to sign up with them, sign up to get your first $5 investment into your account!

I’ll be honest, I was a bit skeptical at the beginning, but I’m so glad I tried it out and saw for myself the abundance that came through, and will continue to come through!

So far, it’s been one of the best decisions I’ve made in the last few years, and I’m only excited to keep seeing my money grow not only for travel but also for wealth in general.

Have you tried Acorns before?

Let me know if you have any questions, and I’ll try to answer as best as I can based on my experience as a user!

To more money growing moments for travel, and freedom!

Like it? Pin it!